Expat tax and finance made simple

Track your world wide net worth, stay on top tax compliance like FBAR and FATCA (Form 8938), and share tax-ready data with your advisor with in single click

What is Aequify

Aequify is for expats including Americans and green card holders living abroad with money across multiple countries. It helps reduce stress with expat taxes, FBAR, and FATCA.

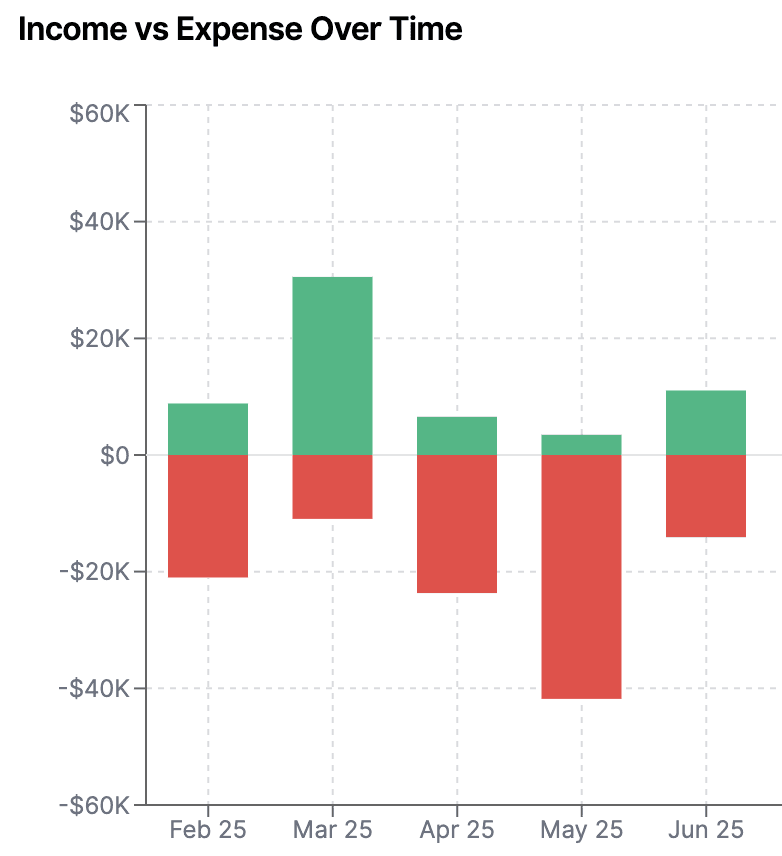

Track Global Finances

See net worth, cashflow, and balances across countries in one dashboard.

Cross-border Tax Outlook

Spot gaps early and understand what may affect your expat tax return across countries.

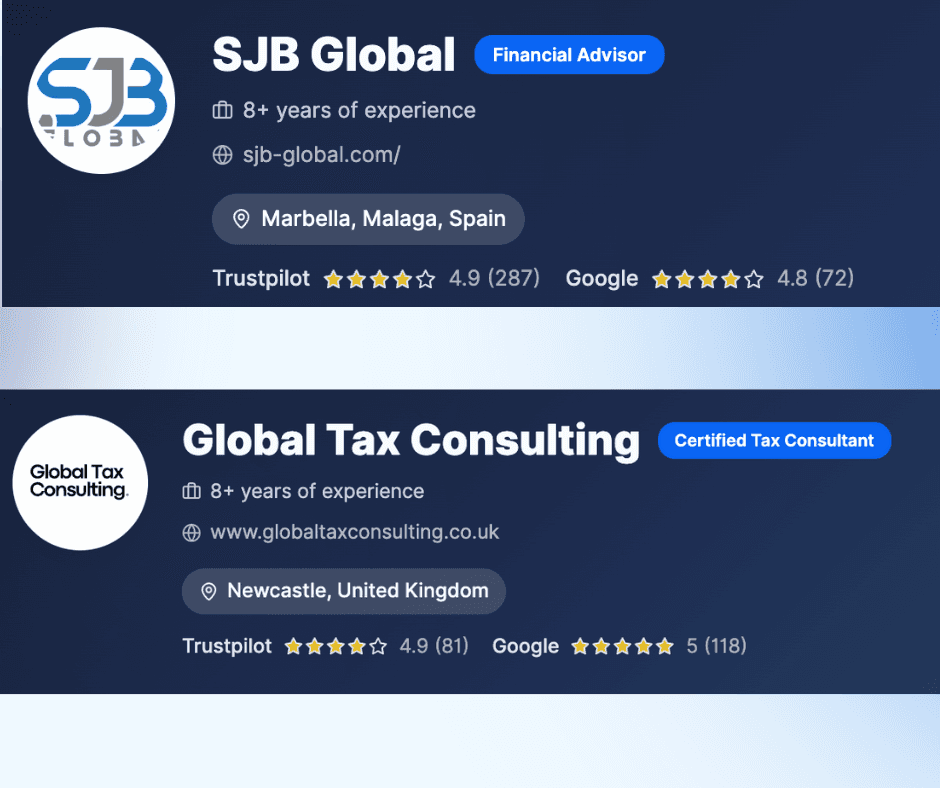

Find International Advisor

Find reputed advisors and send a advisor-ready data pack securely, in a few clicks.

Features

The solution for all your international finance needs

Expats Tax Outlook

Get personalized response to your tax related question

Get personalized response to your tax related question

Get personalized response to your tax related question

Stay Compliant

Get personalized response to your tax related question

Get personalized response to your tax related question

Get personalized response to your tax related question

Account Aggregation

Get personalized response to your tax related question

Get personalized response to your tax related question

Get personalized response to your tax related question

Security

Build for Privacy and Control

Aequify uses read-only connections and strong safeguards so you can view and share data safely.

Testimonials

What our customers have to say

“I had 18 different apps to track my banks and investments. It made it hard to see the full picture of my finances. Aequify brings everything into one secure, unified dashboard, making it much easier to manage my global financial life from a single place”

David W.

Canadian expat in the U.S.

"I’d spend hours combing through bank statements from four UK accounts to complete my FBAR. Aequify pulled the details instantly for me…it was a lifesaver."

Taniya R

U.S. expat in the U.K.

"This year, it took me less than 2 mins to know whether to file FBAR and FATCA and to file it."

Joseph J.

U.S. expat in Spain

"My favourite feature is the ability share my data with my financial advisor right from Aequify with a single click. I don't need to fill long forms and download statements. I feel in control of my data and know when my advisor downloaded my data and I can remove access anytime."

Michael C.

U.S. expat in France

Frequently asked questions

Don’t take our word for it, here’s what our users had to say about us.